Vietnam has transformed from an agrarian economy into one of the most dynamic markets in Southeast Asia, driven by a mix of strong governance, robust international trade, and a young, rapidly growing population.

Over the past few decades, the Vietnam economy has witnessed a massive shift, placing the nation on the radar for investors and travelers alike. In this article, we will explore 10 key figures that encapsulate the strength and potential of Vietnam’s economy.

By understanding these statistics, you’ll get a clearer picture of where Vietnam stands today and its trajectory for the future.

Vietnam economy’s Gross Domestic Product (GDP)

Vietnam’s Gross Domestic Product (GDP) is one of the most telling indicators of the country’s overall economic health. As of 2023, Vietnam’s GDP stands at around $409 billion USD, making it one of the fastest-growing economies in Asia. The growth is largely fueled by manufacturing, agriculture, and services.

Over the past two decades, Vietnam has sustained robust GDP growth. Between 2000 and 2019, Vietnam’s economy grew by an average of 6-7% per year, according to the World Bank. Despite global challenges like the COVID-19 pandemic, Vietnam quickly bounced back, achieving a GDP growth of 8% in 2022.

The government’s vision extends far into the future, with ambitious plans to reach $1.5 trillion USD in GDP by 2045 as a high-income country, becoming one of the 20 biggest economies in the world. This goal is supported by comprehensive development strategies focusing on infrastructure modernization, educational advancement, and digital transformation initiatives.

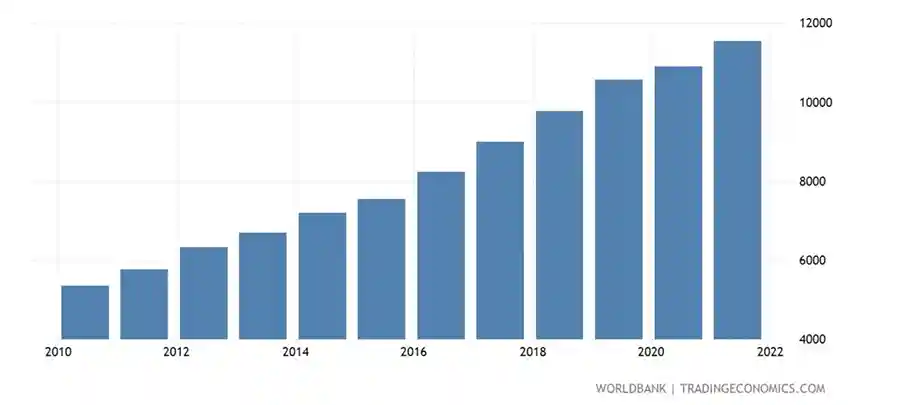

GDP Evolution

GDP per capita

GDP per capita is a vital indicator of Vietnam’s economic performance and living standards. As of 2023, the GDP per capita is estimated to be approximately $4,110 USD, reflecting significant growth from earlier decades. This increase is largely driven by robust economic expansion, which has averaged around 6.3% annually, coupled with industrialization and modernization efforts. The rise in foreign direct investment (FDI) in various sectors, especially manufacturing and technology, has also contributed to job creation and higher wages, enhancing the overall economic output per person.

Despite these positive trends, Vietnam faces challenges in further improving GDP per capita. Income inequality remains a concern, particularly between urban and rural areas, necessitating policies that promote more equitable growth. Additionally, enhancing the quality of education and workforce skills is crucial to meet the demands of an evolving economy and compete globally. Continued investment in infrastructure is also essential to support economic activities and connectivity, ultimately driving higher living standards and positioning Vietnam for sustainable growth in the future.

Vietnam GDP per capita

Vietnam’s economy unemployment rate

The unemployment rate in Vietnam is relatively low compared to other developing nations, reflecting the country’s expanding job market and growing industries. In 2022, Vietnam’s unemployment rate stood at 2.3%, according to the General Statistics Office of Vietnam.

The labor force participation rate is high, especially in the manufacturing and services sectors. Vietnam’s booming tech and tourism industries have provided job opportunities for millions of young workers. However, unemployment spikes were seen during the COVID-19 pandemic, particularly in the tourism and hospitality sectors.

The nation’s workforce has shown impressive adaptability, transitioning from traditional agricultural employment to modern sectors like technology and services. This shift has been particularly beneficial for Vietnam’s young population, who are increasingly finding opportunities in emerging industries.

However, it’s important to note that a significant portion of Vietnam’s workforce is employed in the informal sector, which includes jobs that are not officially registered or regulated. This informal sector accounts for a large percentage of total employment, especially in rural areas and traditional industries. Workers in this sector often lack social protections, such as health insurance or pension benefits, and their employment is less stable and harder to track in official statistics. As a result, the unemployment rate of 2.3% might understate the actual employment challenges, particularly since informal workers may not be captured in official data.

Looking beyond the numbers, Vietnam’s employment landscape is characterized by a dynamic mix of traditional and modern sectors. The government’s focus on developing high-value industries while supporting traditional sectors ensures balanced job creation across the economy. However, addressing the informal sector remains crucial for creating a more inclusive and secure labor market for all Vietnamese workers.

Inflation rate (Consumer Price Index – CPI)

Inflation has been a persistent challenge for Vietnam, particularly due to its rapid economic growth and reliance on imports. In 2022, Vietnam’s inflation rate reached 3.15%, according to the International Monetary Fund (IMF), primarily driven by global supply chain disruptions and rising energy costs. These external pressures have exacerbated the country’s vulnerability to price fluctuations, especially for imported goods.

In 2023, inflation continued to be a concern, with the inflation rate climbing to 3.8% by mid-year, slightly below the government’s target of keeping inflation under 4% annually. This increase was attributed to ongoing disruptions in global markets, energy price volatility, and rising food prices. The Vietnamese government responded with a mix of fiscal measures, such as regulating fuel prices and maintaining food supply chains, to prevent further inflationary pressures.

As of early 2024, inflation has eased slightly to 3.6%, reflecting some success in these efforts. The government’s focus on stabilizing key sectors, like fuel and agriculture, has helped temper price increases. However, inflationary risks remain due to Vietnam’s reliance on imported raw materials and energy, which makes the country susceptible to global price fluctuations.

To address rising inflation, the Vietnamese government has implemented a series of tighter monetary policies, including higher interest rates and stricter lending practices to control money supply growth. Additionally, Vietnam is investing heavily in boosting domestic production to reduce dependency on imports, particularly for essential goods like food, fuel, and raw materials. These efforts aim to shield the economy from external shocks and build greater resilience in key industries.

Looking ahead, the government remains committed to keeping inflation below 4% for 2024 through a combination of monetary tightening and strategic investments in domestic industries. However, external factors such as global energy prices and supply chain disruptions will continue to play a critical role in shaping Vietnam’s inflation outlook.

Public debt of Vietnam economy

Public debt is a key concern for any growing economy, and Vietnam is no exception. As of 2023, Vietnam’s public debt stood at around 39.8% of GDP, a figure that remains manageable by international standards and well below the 60% limit set by the government. This relatively low level of public debt reflects Vietnam’s cautious approach to fiscal management, focusing on maintaining macroeconomic stability while pursuing economic growth.

Vietnam has been diligent in managing its public debt by relying on long-term, concessional borrowing from multilateral organizations and international partners. This strategy allows the country to access funding for vital infrastructure projects at lower interest rates, reducing the burden of debt repayment in the long run. In addition, Vietnam has made significant strides in improving transparency in debt reporting and management, earning international recognition for its prudent fiscal policies.

To avoid placing undue pressure on public finances, Vietnam has increasingly turned to public-private partnerships (PPP) and privatization as key strategies for funding its infrastructure development. These approaches enable the government to leverage private capital and expertise for large-scale projects, particularly in sectors such as transportation, energy, and technology, without dramatically increasing public debt.

For example, PPPs have been instrumental in the construction of highways, ports, and renewable energy projects, which are critical for maintaining Vietnam’s growth trajectory. By sharing the financial and operational responsibilities with private entities, the government can reduce its upfront expenditure while still achieving infrastructure goals. Notable examples include the development of the North-South Expressway and various solar and wind energy projects that aim to reduce the country’s dependence on fossil fuels.

Privatization, or the partial sale of state-owned enterprises (SOEs), is another strategy Vietnam has adopted to enhance efficiency and reduce fiscal strain. The government has been gradually reducing its ownership in key sectors like telecommunications, banking, and manufacturing, encouraging private sector participation and improving competitiveness. This approach not only generates revenue for the state but also reduces the need for direct government spending on these sectors.

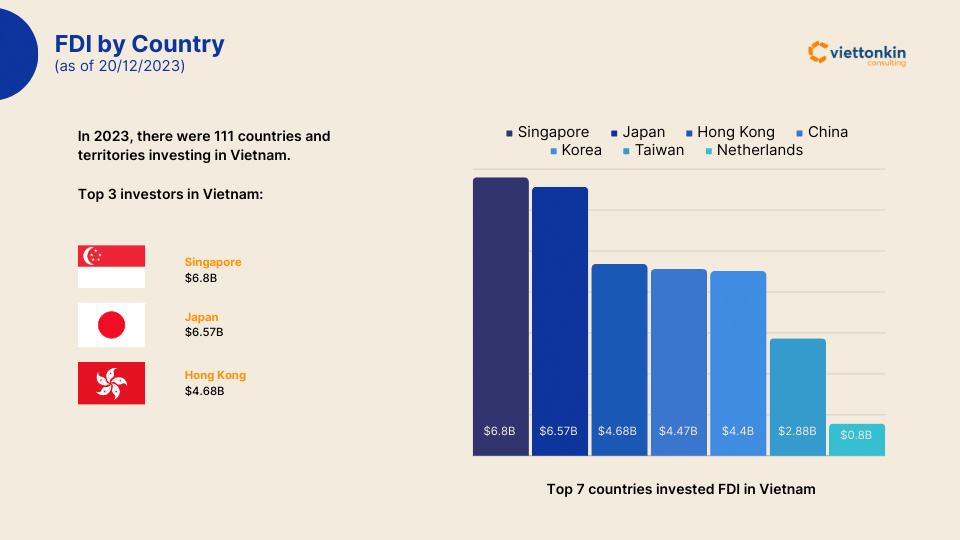

Foreign Direct Investment (FDI)

Foreign Direct Investment (FDI) has been a major driving force behind Vietnam’s rapid economic growth and industrialization. In 2023, Vietnam attracted $20.21 billion in FDI, reflecting its appeal as a destination for global businesses seeking to diversify their production bases. FDI has played a pivotal role in transforming Vietnam into one of Southeast Asia’s leading manufacturing hubs.

The largest FDI inflows have been directed toward manufacturing, real estate, and high-tech industries. Key investors include Japan, South Korea, and Singapore, with Vietnam increasingly seen as a crucial production hub for multinational corporations. Companies like Samsung, Intel, LG, and Foxconn have established significant manufacturing operations in the country, contributing to Vietnam’s export-led growth.

Dependency on FDI and export dynamics

A major aspect of Vietnam’s economic structure is its heavy dependency on FDI to drive exports. Almost 70% of Vietnam’s total exports are produced by FDI companies, particularly in key sectors such as electronics, textiles, and machinery. For instance, Samsung alone accounts for roughly 20-25% of the country’s total exports, underscoring the critical role of foreign firms in Vietnam’s global trade presence. While this FDI-driven export model has significantly boosted Vietnam’s economic development, it also poses certain risks, such as vulnerability to shifts in global trade patterns or decisions made by multinational companies to relocate their operations.

Vietnam’s reliance on foreign firms for such a large portion of its export earnings highlights the need for the country to strengthen its domestic supply chains and foster homegrown innovation. Although Vietnam has successfully positioned itself as a key alternative to China for manufacturing, further efforts are needed to reduce dependency on FDI for export growth.

Challenges of technology transfer

One of the major challenges facing Vietnam in its reliance on FDI is the limited technology transfer from foreign to domestic firms. While many multinational corporations have set up manufacturing plants and operations in Vietnam, the spillover effects in terms of transferring advanced technologies and skills to local businesses have been less significant than anticipated. This is particularly true in high-tech sectors, where domestic companies often struggle to integrate into global supply chains due to their lack of access to cutting-edge technologies and insufficient research and development (R&D) capabilities.

Vietnam’s government has recognized this issue and is actively working to promote policies that encourage greater technology transfer as part of its FDI strategy. These policies include offering incentives for foreign investors to partner with local companies, invest in R&D, and build local talent pools. By focusing on these areas, Vietnam aims to ensure that FDI not only drives economic growth but also helps to develop a more competitive domestic industry.

Future directions and high-quality FDI

Looking ahead, the Vietnamese government is focusing on attracting high-quality FDI in sectors such as technology, green energy, and advanced manufacturing. The goal is to move beyond labor-intensive industries and toward higher value-added sectors that can contribute more significantly to sustainable economic growth. To this end, Vietnam is offering various incentives for foreign investors who bring in advanced technologies and adhere to environmental sustainability standards.

Additionally, the government is working to strengthen its digital economy and develop an innovation ecosystem that can support both foreign and domestic firms. This will be crucial as Vietnam seeks to climb up the global value chain and reduce its reliance on low-cost manufacturing, which has been a hallmark of its economy for the past few decades.

Top countries investing in Vietnam.

Trade surplus

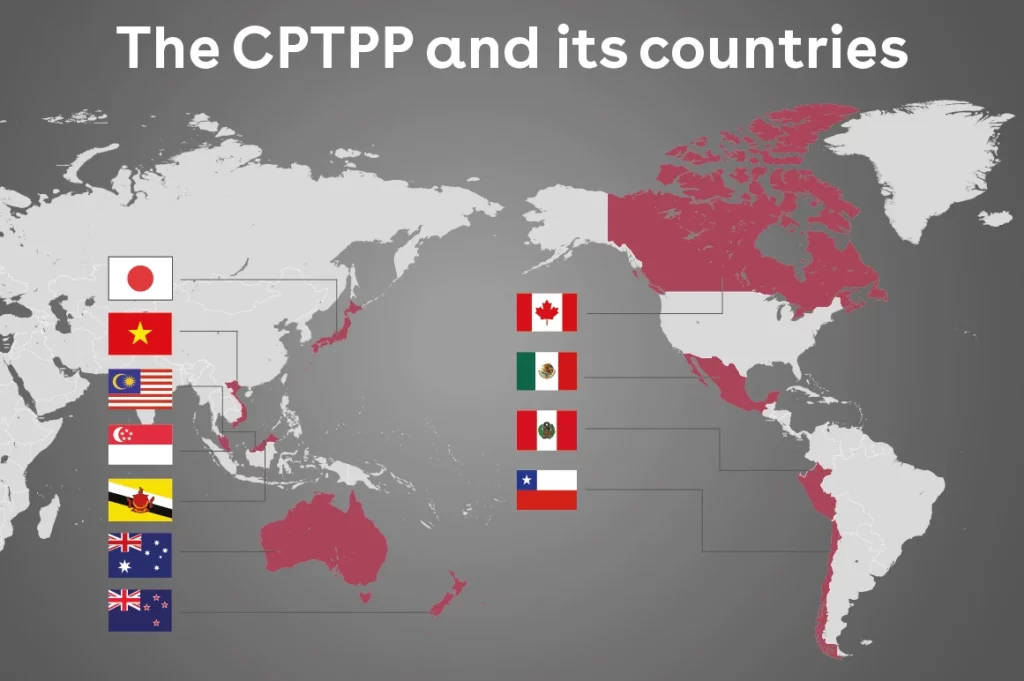

Vietnam has consistently maintained a trade surplus, which has played a key role in bolstering its economy. In 2022, the country recorded a trade surplus of $12.4 billion, driven by strong export performance across sectors such as electronics, textiles, footwear, and agricultural products like coffee and rice. Vietnam’s export-driven economy has also benefited from numerous free trade agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which has opened up new markets and reduced tariffs on key export goods.

However, despite these gains, Vietnam faces several challenges in sustaining and maximizing the benefits of its trade surplus:

Low domestic value-added in exports: Vietnam’s exports, particularly in high-tech sectors, are often low in domestic value-added content. Many foreign firms assemble products in Vietnam using imported components and materials, limiting the extent to which Vietnam can capture higher value from its exports. As a result, while Vietnam may post a trade surplus, the actual economic benefits in terms of local income and technological development may be less than anticipated.

Technology transfer and industrial upgrading: Vietnam faces challenges in achieving greater technology transfer from FDI firms, which would help local industries move up the value chain. Without substantial industrial upgrading, domestic firms remain unable to integrate fully into global supply chains or become competitive exporters themselves. This dependency on low-cost manufacturing limits the long-term sustainability of the trade surplus.

Infrastructure and logistics bottlenecks: While Vietnam is investing heavily in upgrading ports, logistics, and transport infrastructure to facilitate smoother and more cost-effective trade with international markets, these efforts are still catching up with the rapid pace of export growth. Bottlenecks at key ports and inefficiencies in the logistics sector can increase costs and slow down export deliveries, potentially undermining the competitiveness of Vietnamese products on the global stage.

To maintain its trade surplus while addressing these challenges, Vietnam is not only focused on improving its physical infrastructure but also working to strengthen domestic industries. Encouraging higher domestic value-added in exports, promoting technology transfer from foreign firms, and fostering homegrown innovation are key goals. Additionally, the government is keen to diversify export markets to reduce dependency on any single region and ensure more stable growth.

10 countries members of CPTPP agreement after the leaving of the USA

Foreign exchange reserves of Vietnam economy

Foreign exchange reserves are critical for maintaining currency stability and ensuring liquidity in times of economic stress. Vietnam’s foreign exchange reserves reached a record high of $109 billion in 2022. According to data on March 1, 2024, Vietnam’s foreign exchange reserves reached over 93 billion USD, ranking 31st in the world.

Strong export performance and remittances from overseas Vietnamese have contributed to these robust reserves. The government continues to maintain a stable exchange rate, which boosts investor confidence and supports long-term economic growth.

Vietnam’s healthy reserves give it the flexibility to manage economic shocks and currency fluctuations, particularly in the face of external challenges like global inflation and supply chain disruptions.

Poverty rate

Vietnam’s economic growth has significantly reduced poverty rates, which fell from over 60% in the early 1990s to just 2.9% in 2022. This transformation represents one of the most successful poverty reduction campaigns in economic history.

Some policy initiatives such as cash transfers, education programs, and healthcare reforms have been key to reducing poverty, particularly in rural areas. Continued focus on inclusive growth and equitable access to resources remains a top priority.

While Vietnam has made tremendous strides, challenges remain, particularly in addressing income inequality and ensuring that vulnerable populations are included in the nation’s growth.

Contributions of the tourism industry

Tourism has become a cornerstone of Vietnam’s economy, contributing 7.3% of the country’s GDP in 2023, according to the Ministry of Culture, Sports, and Tourism, a decrease from the 9.2% contribution seen in 2019 due to the impacts of the COVID-19 pandemic. In terms of employment, the tourism sector supported over 4 million jobs in 2023, providing vital employment opportunities across the country.

International tourists continue to bring significant revenue to Vietnam, especially in key cities like Hanoi, Ho Chi Minh City, and the central coastal regions. The country’s rich cultural heritage, stunning natural landscapes, and affordability make it a popular destination for global travelers. Popular destinations such as Ha Long Bay, Hoi An, and Phu Quoc continue to attract visitors from around the world, further boosting the local economy.

To strengthen its position in the global tourism market, the Vietnamese government is focused on sustainable tourism development, enhancing infrastructure, and promoting Vietnam as a safe and vibrant post-pandemic destination. Major initiatives include investments in airport expansions, improved transportation networks, and efforts to ensure responsible tourism that preserves the environment and cultural heritage. These efforts aim to attract higher-value visitors and support the long-term recovery and growth of the industry.

Vietnam’s potential and future directions

Vietnam’s economy, with its impressive growth, robust trade surplus, and strong foreign investment, presents significant opportunities for investors and travelers alike. The country’s focus on digital transformation, sustainable development, and social inclusion suggests a thoughtful approach to future challenges. As Vietnam continues its development journey, it remains an increasingly attractive destination for both investment and tourism, offering unique opportunities in one of Asia’s most dynamic economies.

However, challenges such as inflation and public debt remain. The government’s forward-thinking policies aim to address these issues while continuing to modernize the economy and reduce poverty.

With its rapidly growing economy, Vietnam is a must-visit destination for travelers and investors alike. From rich cultural heritage to breathtaking landscapes, every journey to Vietnam offers unique experiences while supporting local economic growth. Start your adventure today and be part of Vietnam’s adventure!

For further insights on Vietnam’s economic outlook, follow the country overview of the World Bank.